Best CRM For Financial Services: Enhancing Customer Relationships

Best CRM for Financial Services sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. CRM software plays a crucial role in the financial sector, revolutionizing how institutions manage customer relationships and drive business growth.

In this comprehensive guide, we will delve into the key features, customization options, security measures, automation capabilities, and future trends surrounding CRM for financial services, providing a holistic view of this essential tool in the industry.

Introduction to CRM for Financial Services

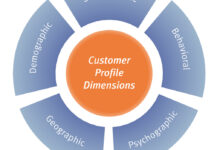

In the financial services industry, Customer Relationship Management (CRM) refers to the strategies, practices, and technologies that financial institutions use to manage and analyze customer interactions and data throughout the customer lifecycle. CRM in financial services focuses on building and maintaining customer relationships, improving customer satisfaction, and increasing customer retention.

Importance of Using CRM Software in the Financial Sector

CRM software plays a crucial role in the financial sector by providing a centralized platform for managing customer information, tracking customer interactions, and automating various processes. It helps financial institutions streamline their operations, enhance customer service, and personalize marketing efforts to meet the evolving needs of customers.

Benefits of CRM for Financial Institutions

- Improved customer retention and loyalty through personalized interactions.

- Enhanced cross-selling and upselling opportunities by analyzing customer data.

- Increased operational efficiency by automating routine tasks and workflows.

- Better compliance management through centralized data storage and tracking.

Key Features of CRM for Financial Services

- Integration with core banking systems for seamless data exchange.

- Comprehensive customer profiles with detailed transaction histories.

- Automated marketing and sales processes for targeted campaigns.

- Advanced security features to protect sensitive financial data.

CRM Implementation in Traditional Banks vs. Digital-only Banks

Traditional banks often face challenges in integrating CRM software due to legacy systems and complex processes, while digital-only banks have the advantage of starting with a clean slate and implementing CRM solutions that are inherently digital-friendly.

Role of AI and Machine Learning in Enhancing CRM Capabilities

AI and machine learning technologies empower CRM systems in financial services to analyze vast amounts of data, predict customer behavior, automate customer interactions, and provide personalized recommendations. This leads to improved decision-making and enhanced customer experiences.

Integrating CRM Software into Existing Financial Institution’s Operations

- Assess current processes and identify areas where CRM can add value.

- Select a CRM software provider that aligns with the institution’s needs.

- Train employees on using the CRM system effectively.

- Gradually transition to the CRM system, ensuring data accuracy and security.

Impact of Regulatory Compliance on CRM Strategies in the Financial Sector

Regulatory compliance requirements, such as GDPR and KYC regulations, influence how financial institutions collect, store, and use customer data within their CRM systems. Compliance considerations shape CRM strategies to ensure data privacy and security.

Types of CRM Software for Financial Services

When it comes to CRM software for financial services, there are different types available, each offering unique features and benefits. Let’s compare and contrast some of the most common options and discuss their advantages and disadvantages.

Cloud-based CRM Solutions vs. On-premise Options

Cloud-based CRM solutions and on-premise options are two primary types of CRM software used in the financial services industry. Here’s how they differ:

- Cloud-based CRM Solutions: These are hosted on the vendor’s servers and accessed through a web browser. They offer the advantage of being accessible from anywhere with an internet connection, making them ideal for remote teams. Additionally, updates and maintenance are handled by the vendor, reducing the burden on internal IT teams.

- On-premise Options: On-premise CRM software is installed and managed on the company’s own servers and infrastructure. While this provides more control over data security and customization options, it also requires a higher upfront investment and ongoing maintenance costs.

Cloud-based CRM solutions offer greater flexibility and scalability, while on-premise options provide more control over data and customization.

Advantages and Disadvantages of Each Type

| CRM Software Type | Advantages | Disadvantages |

|---|---|---|

| Cloud-based CRM Solutions | Accessibility from anywhere, automatic updates, scalability. | Dependence on internet connection, potential security concerns. |

| On-premise Options | Control over data security, customization options. | Higher upfront costs, maintenance burden on internal IT teams. |

Customization and Integration

Customization plays a crucial role in CRM software for financial services as it allows companies to tailor the system to their specific needs and workflows. This not only enhances efficiency but also ensures that the software aligns with the unique requirements of financial institutions.

Importance of Customization in CRM Software

- Customized fields and data structures: Financial services often have unique data requirements that can be accommodated through customization, such as capturing specific customer information or tracking complex financial transactions.

- Personalized workflows: CRM systems can be customized to automate processes specific to financial services, such as lead management, client onboarding, or compliance tracking.

- Integration with existing systems: Customization allows CRM software to seamlessly integrate with other tools commonly used in the financial sector, such as accounting software, portfolio management systems, or trading platforms.

Examples of Customization in CRM Systems

- Creating custom reports and dashboards tailored to financial metrics and key performance indicators (KPIs).

- Configuring automated alerts and notifications for important events, such as expiring contracts or high-risk transactions.

- Adapting the user interface to match the branding and user experience standards of the financial institution.

Integration of CRM Software with Other Tools

- Integration with accounting software for seamless data transfer and financial reporting.

- Connecting CRM systems with portfolio management tools to track client investments and performance.

- Linking CRM software with email marketing platforms for targeted client communications and lead nurturing.

Security and Compliance

In the financial services industry, security and compliance are of utmost importance to protect sensitive client data and ensure adherence to regulations. The best CRM for financial services must implement robust security measures and features to safeguard information and maintain compliance with industry standards.

Encryption Methods

- Implementing end-to-end encryption: The CRM system should encrypt data in transit and at rest to prevent unauthorized access.

- Utilizing AES (Advanced Encryption Standard): AES encryption is a widely accepted encryption method for securing sensitive information.

- Enforcing SSL/TLS protocols: Secure Socket Layer (SSL) and Transport Layer Security (TLS) protocols help establish secure communication channels.

Access Control Features

- Role-based access control: CRM software should allow administrators to define access levels and permissions for different users based on their roles within the organization.

- Two-factor authentication: Implementing two-factor authentication adds an extra layer of security to verify the identity of users accessing the CRM system.

- Audit trails: Maintaining audit trails helps track user activity and changes made to client data, ensuring accountability and transparency.

GDPR Compliance

- Data protection policies: CRM systems can assist financial services companies in implementing data protection policies and procedures to comply with GDPR requirements.

- Consent management: CRM platforms enable organizations to manage customer consent for data processing in accordance with GDPR regulations.

- Data portability: CRM systems should support data portability features to facilitate the transfer of customer data upon request in compliance with GDPR.

User Activity Tracking

- Monitoring user access: CRM software can track user logins, actions taken, and changes made to client records to ensure compliance with industry standards.

- Automated alerts: Setting up automated alerts for unusual user activity or unauthorized access helps organizations detect and respond to security breaches promptly.

- Auditing tools: CRM platforms offer auditing capabilities to generate reports on user activity, data modifications, and system access for compliance purposes.

Automation and Workflow Efficiency

Automation plays a crucial role in improving workflow efficiency within the healthcare setting. By utilizing machine learning algorithms, tasks can be automated to streamline processes and enhance overall productivity.

Examples of Automation in Healthcare

- Appointment Scheduling: Machine learning algorithms can analyze patient data and availability to automatically schedule appointments, reducing the workload on administrative staff.

- Medical Billing: Automation can help streamline the billing process by accurately coding and submitting claims, reducing errors and improving revenue cycle management.

- Patient Monitoring: Machine learning can be used to continuously monitor patient data, alerting healthcare providers to any abnormalities or potential issues in real-time.

Benefits of Automated Workflows

- Reduced Human Error: Automation minimizes the risk of manual errors in tasks like data entry, leading to more accurate and reliable results.

- Increased Productivity: By automating routine tasks, healthcare professionals can focus more on patient care and complex decision-making, ultimately improving efficiency.

- Enhanced Patient Care: Automated workflows can help healthcare providers deliver timely and personalized care to patients, improving overall satisfaction.

Challenges in Integrating Machine Learning Automation

- Data Quality: Ensuring the accuracy and completeness of data is crucial for the success of machine learning algorithms in healthcare automation.

- Regulatory Compliance: Healthcare systems must adhere to strict regulations and privacy laws when implementing automation, requiring careful consideration and compliance measures.

- Implementation Costs: Integrating machine learning automation may require significant investment in technology and training, posing financial challenges for healthcare organizations.

Reporting and Analytics

Reporting and analytics play a crucial role in CRM software for financial services, providing valuable insights into customer behavior, trends, and performance metrics. By analyzing data collected through CRM systems, financial institutions can make informed business decisions and improve customer relationships.

Types of Reports and Analytics Tools

There are several types of reports and analytics tools that are essential for financial institutions to effectively utilize CRM data:

- Financial Performance Reports: These reports provide an overview of key financial metrics, such as revenue, profit margins, and return on investment.

- Customer Segmentation Analysis: This tool helps in identifying different customer segments based on characteristics like demographics, behavior, and preferences.

- Sales Forecasting: By analyzing historical data and trends, financial institutions can predict future sales and revenue projections.

CRM Data Analysis Driving Business Decisions

CRM data analysis can drive business decisions in the finance industry by:

- Identifying Upselling and Cross-Selling Opportunities: Analyzing customer data can help financial institutions identify opportunities to upsell or cross-sell products and services to existing customers.

- Improving Customer Retention: By analyzing customer interactions and feedback, financial institutions can enhance customer service and retention strategies.

- Optimizing Marketing Campaigns: CRM data analysis can help in evaluating the effectiveness of marketing campaigns and targeting the right audience for better results.

Customer Relationship Management

Customer Relationship Management (CRM) software plays a crucial role in enhancing customer relationships within the financial sector. By leveraging CRM systems, financial institutions can personalize interactions, streamline communication, and provide tailored solutions to meet customer needs effectively.

Examples of CRM Strategies in Financial Services

- Segmentation: Divide customers into different groups based on their needs, behaviors, and preferences to tailor marketing campaigns and services.

- Personalization: Use customer data to personalize interactions, offers, and communication, creating a more engaging and relevant experience for clients.

- Automated Follow-ups: Set up automated reminders and follow-up emails to stay in touch with customers, ensuring timely communication and relationship nurturing.

Role of CRM in Customer Retention and Acquisition

CRM systems are instrumental in improving customer retention and acquisition for financial institutions. By maintaining detailed customer profiles, tracking interactions, and analyzing data, CRM software enables institutions to:

- Identify Cross-Selling Opportunities: By understanding customer preferences and behaviors, institutions can identify opportunities to offer additional products or services, increasing customer loyalty and retention.

- Improve Customer Service: CRM systems provide a centralized view of customer information, enabling representatives to deliver personalized and efficient service, ultimately enhancing customer satisfaction and retention.

- Enhance Customer Loyalty Programs: By tracking customer engagement and feedback, institutions can tailor loyalty programs and incentives to reward and retain valuable customers.

Mobile Accessibility and User Experience

In today’s fast-paced world, mobile accessibility has become a crucial aspect of CRM software for financial services. With professionals constantly on the move, having access to important client information and data at their fingertips is essential for maintaining strong customer relationships and providing timely assistance.

A seamless user experience is paramount in ensuring the effectiveness of CRM systems in the financial services industry. Financial professionals need a user-friendly interface that allows them to easily navigate through client profiles, track interactions, and input data efficiently. A well-designed CRM with intuitive mobile features can streamline processes and improve productivity.

Benefits of Mobile Features for Financial Professionals

- Real-time data access: Financial advisors can access client information, account details, and communication history on the go, enabling them to provide prompt assistance and personalized service.

- Mobile notifications: Instant alerts for upcoming meetings, follow-up tasks, and important client updates ensure that financial professionals stay on top of their daily activities and deadlines.

- Offline access: The ability to work offline and sync data once back online ensures that financial professionals can continue working even in areas with limited connectivity, maintaining productivity at all times.

- Mobile-friendly dashboards: Customizable dashboards that display key metrics, reports, and performance indicators allow financial professionals to quickly assess the status of their accounts and make informed decisions on the fly.

Scalability and Growth

Scalability is a crucial factor when it comes to CRM software used in the financial services industry. It refers to the ability of the CRM system to handle an increasing amount of data, users, and transactions without compromising performance.

Supporting Growth and Expansion

CRM systems play a vital role in supporting the growth and expansion of financial institutions by providing a centralized platform for managing customer relationships, improving communication, and streamlining processes. Here are some ways scalable CRM solutions have helped finance companies adapt to changing business needs:

- Increased Efficiency: Scalable CRM software allows financial institutions to handle a growing customer base and a higher volume of transactions without experiencing any slowdowns. This improved efficiency enables companies to focus on strategic initiatives and business growth.

- Flexibility: Scalable CRM solutions can easily adapt to the changing needs of financial institutions. Whether it’s adding new features, integrating with other systems, or expanding to new markets, a scalable CRM system provides the flexibility to accommodate growth.

- Customization: Scalable CRM software offers the ability to customize workflows, reports, and dashboards to meet specific business requirements. This level of customization ensures that the CRM system can grow alongside the financial institution and support its unique processes.

- Scalable Infrastructure: Scalable CRM solutions are designed to grow with the company, whether it’s through cloud-based options that can easily scale up or on-premise solutions that can be expanded as needed. This ensures that the CRM system can support the increasing demands of a growing business.

Training and Support

Training programs and ongoing support play a crucial role in the successful implementation and utilization of CRM software in financial services. Let’s delve into the importance of training and support for CRM systems in this sector.

Importance of Training Programs

Training programs are essential to ensure that users understand how to effectively use CRM software. In the financial services industry, where data accuracy and compliance are paramount, proper training can help employees navigate the system efficiently and adhere to regulatory requirements. Effective training programs can also increase user adoption rates, leading to better utilization of CRM functionalities.

- Interactive training sessions tailored to the specific needs of financial institutions can help employees grasp the intricacies of the CRM software.

- Hands-on training with real-life scenarios can simulate actual work situations, enabling users to apply their knowledge in practical settings.

- On-demand training resources such as video tutorials and user guides can supplement formal training sessions and serve as refresher materials for users.

Role of Ongoing Support and Maintenance

Ongoing support and maintenance are crucial in ensuring that CRM systems continue to deliver value to financial institutions. Support mechanisms help address user queries, troubleshoot technical issues, and adapt the software to evolving business needs. Regular maintenance activities such as updates and system enhancements contribute to the longevity and efficiency of CRM systems.

- 24/7 technical support ensures that users can receive assistance whenever they encounter issues with the CRM software, minimizing downtime and disruption.

- Regular system audits and performance evaluations can identify areas for improvement and optimization, enhancing the overall functionality of the CRM system.

- Feedback mechanisms that allow users to provide input on the CRM software can help developers prioritize enhancements and updates based on user needs and preferences.

Effective Training Strategies and Support Mechanisms

Financial institutions can implement various strategies to ensure effective training and support for CRM software users. These strategies aim to empower users with the knowledge and resources needed to maximize the benefits of CRM systems.

- Peer-to-peer learning sessions where experienced users mentor new employees can facilitate knowledge sharing and skill development within the organization.

- Gamified training modules that incentivize user participation and engagement can make the learning process more interactive and enjoyable.

- Regular training assessments and certification programs can measure user proficiency and identify areas for improvement, guiding the development of personalized training plans.

Industry-Specific Features

When it comes to the best CRM for financial services, industry-specific features play a crucial role in meeting the unique needs of financial institutions. These specialized functionalities are tailored to address the specific requirements and challenges faced by organizations in the financial sector.

Data Security and Compliance Features

In the financial services industry, data security and compliance are of utmost importance. A robust CRM designed for financial institutions should have advanced security features such as encryption, role-based access control, and audit trails to ensure the protection of sensitive customer information and adherence to regulatory requirements. Compliance features should enable seamless integration of industry regulations and standards to support the organization’s compliance efforts.

Integration with Financial Tools

Another key aspect of industry-specific CRM software is its ability to integrate seamlessly with other financial tools like accounting software or investment platforms. This integration streamlines processes, enhances data accuracy, and provides a holistic view of customer interactions and financial data. By connecting CRM with financial tools, organizations can improve operational efficiency and deliver a more personalized experience to clients.

Successful Implementation Examples

Several financial organizations have successfully implemented industry-specific CRM solutions to drive business growth and improve customer relationships. For instance, a leading investment firm leveraged a CRM system with specialized features for wealth management to enhance client communication, automate repetitive tasks, and gain valuable insights for informed decision-making. By customizing the CRM to align with their unique business processes, the firm achieved greater operational efficiency and increased client satisfaction.

Case Studies and Success Stories

In the world of financial services, implementing CRM software has proven to be a game-changer for many institutions. Let’s delve into some real-life examples of financial institutions that have successfully integrated CRM solutions and the impact it had on their operations.

Impact on Customer Relationship Management

- One major bank saw a significant improvement in customer satisfaction levels after implementing a CRM system. By centralizing customer data and streamlining communication channels, they were able to provide more personalized services and address customer queries more efficiently.

- Another financial institution reported a notable increase in customer retention rates post-CRM implementation. The software enabled them to track customer interactions, identify trends, and tailor their services to meet individual needs, ultimately fostering stronger relationships with clients.

Financial Performance and Efficiency

- A credit union witnessed a substantial decrease in operational costs following the adoption of CRM software. By automating repetitive tasks, optimizing workflows, and enhancing data accuracy, they were able to operate more efficiently and allocate resources more effectively.

- An investment firm experienced a boost in revenue generation after implementing CRM solutions. By utilizing the software to analyze client portfolios, track leads, and forecast market trends, they were able to make data-driven decisions that led to increased profitability.

Scalability and Adaptability

- A small community bank successfully scaled its operations with the help of a flexible CRM system. As the institution grew, the software seamlessly accommodated the increasing volume of data and transactions, ensuring continued smooth operations without compromising on service quality.

- A multinational financial services corporation utilized CRM software to standardize processes across multiple branches and regions. The software’s customization and integration capabilities allowed for consistent service delivery and streamlined communication channels, regardless of geographical boundaries.

Future Trends in CRM for Financial Services

As technology continues to evolve, the future of CRM in the financial sector is constantly being shaped by emerging trends. Let’s explore some of the key developments that are revolutionizing CRM practices specifically within the finance industry.

AI, Machine Learning, and Automation in CRM

- AI and machine learning algorithms are being increasingly integrated into CRM systems to analyze customer data and provide personalized insights.

- Automation tools are streamlining processes, such as customer interactions and data entry, to enhance efficiency and productivity.

- These technologies are enabling financial institutions to deliver more proactive and targeted services to their clients, ultimately improving customer satisfaction and retention rates.

Blockchain Technology in CRM

- Blockchain technology has the potential to revolutionize CRM tools within the financial industry by ensuring secure and transparent transactions.

- By leveraging blockchain, financial institutions can enhance data security, reduce fraud risks, and build trust with their customers through immutable records.

- This technology is expected to play a significant role in reshaping customer relationships and improving overall CRM practices in the financial services sector.

Data Analytics and Customer Relationship Management

- Data analytics tools are becoming increasingly essential for financial institutions to gain valuable insights into customer behavior and preferences.

- By leveraging data analytics, CRM systems can better tailor their services, predict customer needs, and drive more targeted marketing campaigns.

- These insights are crucial for enhancing customer relationship management strategies and fostering stronger connections with clients in today’s digital age.

CRM Implementation in Traditional Banks vs. Fintech Companies

- Traditional banks are often faced with legacy systems and complex infrastructures, making CRM implementation a challenging process.

- On the other hand, fintech companies have the advantage of agility and flexibility in adopting CRM solutions, allowing for quicker and more seamless integration.

- Both sectors are focusing on enhancing customer experiences through CRM, but the approach and implementation strategies may differ based on their organizational structures.

Personalized Customer Experiences in CRM Systems

- Personalization is becoming a key differentiator in the development of CRM systems for financial services, as customers increasingly expect tailored interactions.

- By providing personalized experiences, financial institutions can build stronger relationships with their clients, increase brand loyalty, and drive business growth.

- The future of CRM in the financial sector will undoubtedly prioritize customization and personalization to meet the evolving needs and expectations of customers.

Implementation Strategies and Best Practices

Implementing CRM software for financial services requires a well-thought-out plan and execution. Success in deployment and adoption is crucial for maximizing ROI and ensuring a smooth transition to the new system. Customization, training, and key factors play a significant role in the overall success of CRM implementation in financial institutions.

Key Steps in Implementing CRM Software

- Assessing current processes and identifying areas for improvement.

- Setting clear objectives and goals for the CRM system.

- Choosing the right CRM software that aligns with the specific needs of financial services.

- Customizing the CRM platform to match the unique requirements of the institution.

- Training staff effectively on how to use the new CRM system.

- Regularly monitoring and evaluating the performance of the CRM software.

Best Practices for Successful CRM Deployment

- Engage key stakeholders from different departments in the planning and implementation process.

- Ensure data accuracy and integrity during the data migration process.

- Provide ongoing support and training to users to encourage adoption and maximize system utilization.

- Implement a phased approach to deployment to minimize disruptions to daily operations.

- Regularly communicate updates and progress to all staff members to maintain transparency and buy-in.

Tips for Maximizing ROI and Ensuring Smooth Transition

- Measure and track key performance indicators to gauge the impact of the CRM system on business outcomes.

- Regularly review and optimize processes to leverage the full potential of the CRM software.

- Encourage feedback from users to identify areas for improvement and address any challenges promptly.

- Stay informed about new features and updates from the CRM provider to continuously enhance system capabilities.

Key Factors to Consider When Customizing CRM Software

- Align customization with the institution’s specific workflows and processes.

- Ensure seamless integration with existing systems and applications.

- Focus on user experience and interface design to enhance usability and adoption.

- Maintain data security and compliance standards throughout the customization process.

Methods for Training Staff Effectively

- Provide hands-on training sessions with real-life scenarios to demonstrate the practical use of the CRM system.

- Offer online resources, user manuals, and FAQs for self-paced learning and troubleshooting.

- Assign dedicated super users or champions to support and mentor other staff members during the transition phase.

- Conduct regular refresher sessions and workshops to reinforce best practices and ensure continuous skill development.

Closing Summary

In conclusion, the Best CRM for Financial Services is a powerful asset for financial institutions looking to streamline operations, improve customer interactions, and stay ahead of the curve in a rapidly evolving market. By leveraging the right CRM solution, organizations can enhance efficiency, boost profitability, and foster long-lasting client relationships.